We equip and inspire people on their personal journey with Jesus by offering the largest range of Bible and Christian resources in the world with locations in shopping malls, churches, online or wherever needed.

Our Mission

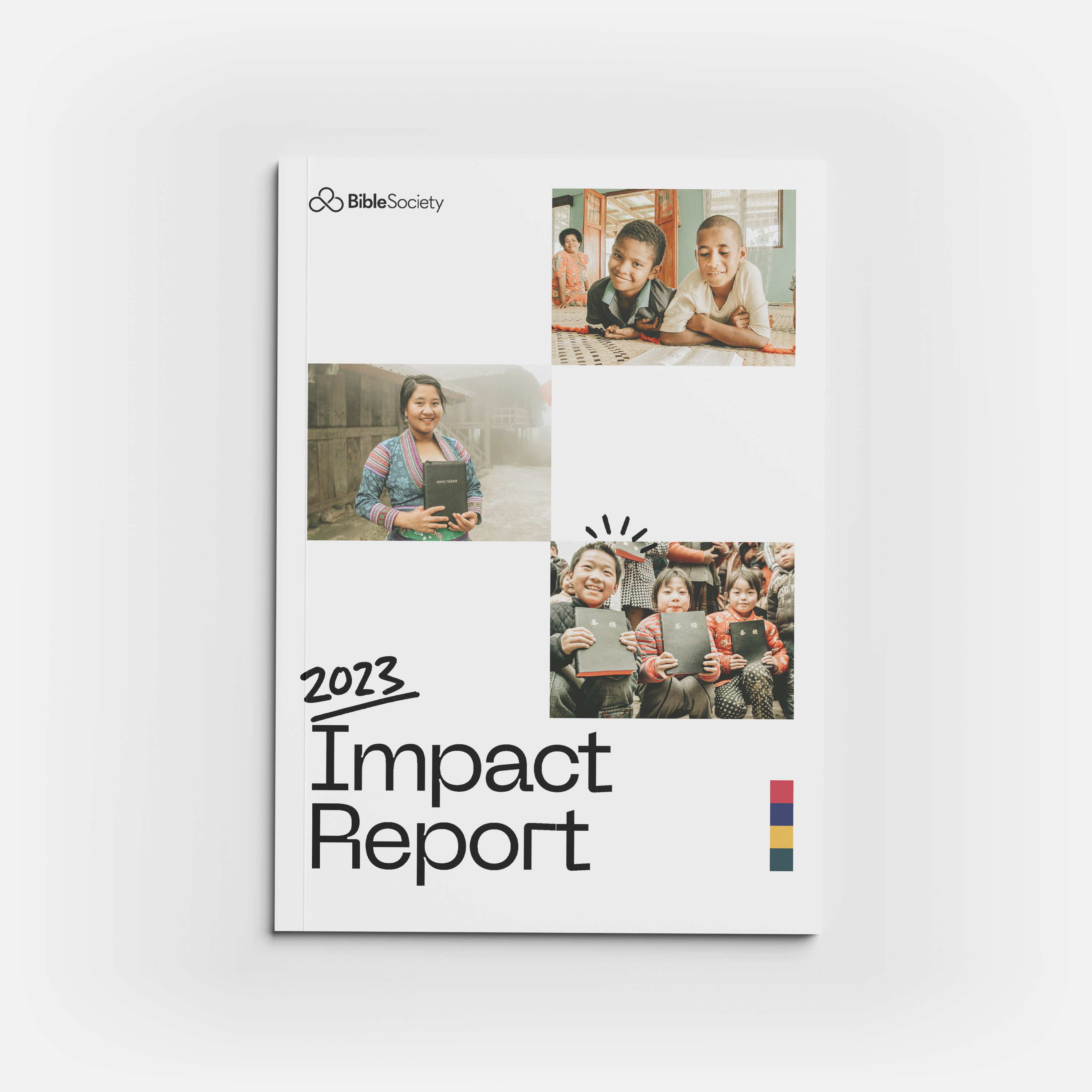

Bible Society Australia exists to impact and influence Australia and the World by Opening The Bible to all people everywhere by all means possible.

Discover how you made a difference in 2023

We set the tone for the national conversation around Christianity via CPX making the truth, beauty and goodness of the Christian message clear to a contemporary, secular audience.

The leading Christian journalistic voice in Australia, speaking with credibility and authority about the issues that affect people in their everyday lives.

We are the harbingers of truth and faith in Australia through our leadership in publishing Bibles and books that speak about the Bible.